Introduction to the used car market in India

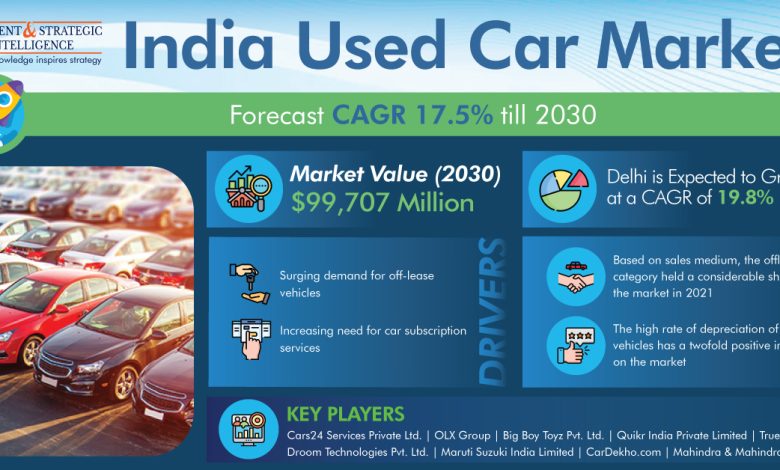

The Indian used car market was valued at $23,355.3 million in 2021, and it is set to reach $99,707 million by 2030, growing at a CAGR of 17.50% between 2021 and 2030, according to a research report by a market research company P&S Intelligence.

The organized players in the regional industry of selling used cars in India are projected to reflect significant growth. The rise in the preference of buyers to spend on certified vehicles from established dealers who provide vehicle certification plays a crucial role in the propulsion of organized players in the used car-selling business. Moreover. The rise in the usage of online portals by both buyers and sellers is projected to expand the organized sector.

Factors driving growth

The organized players are witnessing rapid advances in the Indian used car market. The involvement of individuals instead of organizations creates trust issues among them. It results in increased opportunities for the expansion of organized players, such as OEM and other big players. Such as OLX Autos by OLX Group, Cars24 Services Pvt. Ltd., and Ouickr Cars, a subsidiary of Quikr India Pvt. Ltd. The increased involvement of organized players, and OEMs encourage consumers to buy old cars. Led by an increased sense of reliability and trust.

In addition, an offline sales channel is projected to boost the sales of used cars in India in the near future. It includes traditional brick-and-mortar retail establishments that perform operations in a physical storefront. Ascribed to the rise in consumer preference to purchase a used car from an established dealer. Considering the cruciality of a good consumer experience, and completion of sales. Furthermore, consumers prefer to take a test drive of multiple options available for sale at a dealer’s retail establishment before investing the money.

Challenges facing

Maharashtra captures a significant share of the used car sales revenue in India, ascribed to the growing up young population. High depreciation of luxury products, rise in disposable income, rapid urbanization, and penetration of the internet in non-metros. Moreover. The decline in prices and easy availability of used cars, along with the favorable business environment. Create opportunities for market players to grow their business in the state and thus drive the sales of used cars.

The digital revolution has propelled the sales of used cars, by creating authenticated online retailing platforms for their sales. The surge in the sales of used cars in India online is attributed to increase in the convenience of buyers to search for vehicle details and buyers. Moreover, the major players in the market are making consistent investments to expand themselves. Establish their offline or online retailing and classifieds presence.

Therefore, the rise in the popularity of used cars among consumers is led by the affordable prices of imported vehicles, and a strong belief that timely servicing enhances the life of cars on road.

Government policies and regulations

The growth of this industry is mainly ascribed to the growing internet usage. Which makes information about used cars easily available. Furthermore, the increasing need for off-lease vehicles amid car dealers, franchises, and leasing offices and the surging demand for car subscription services are major factors responsible for increasing the demand for used cars in India.

India is among the fastest-growing industry for large and premium vehicles. Which is appealing to many organized second-hand automobile companies. For example, CarDekho.com, OLX Group, and Quikr India Private Limited for comparing the price and availability of used cars. This helps in formulating the whole process of purchasing quickly and simply.

Impact of digitalization and e-commerce

Based on sales medium, the offline category held a considerable share in the Indian used car market in 2021. This is mainly due to the high consumer preference for buying a used car from a known dealer.

The online category is projected to grow at the fastest in the years to come. This can be accounted to the fact that the need for the dealer has reduced after digitalization. Customers can now swiftly interact with the dealers and access information about used cars via computers and smartphones.

Furthermore, the increasing usage of the internet and ease of research and shopping through the online method is projected to drive the category in the future.

Unorganized businesses in India are dominating the industry. The majority of transactions are done by people trying to buy and sell cars. As the involved parties are individuals and not organizations. Sometimes it is hard to build trust among the parties involved. This raises the need for organized players, including large companies and OEMs.

As their participation surges, consumers will be motivated to purchase second-hand cars, because of the snowballing trust and reliability.

Future prospects and potential growth areas

The high depreciation rate of luxury vehicles impacts the market positively. The drop in the resale value of a vehicle increases its demand. Because of an inverse relationship between demand and price. The increase in the car’s depreciation value is a reason for a drop in resale value, therefore encouraging the car owner to sell it sooner, which decreases the average age of owning the car.

With the growing internet usage and rapid digitalization, entry of key players to organize the industry, and easy availability of information about the cars will help propel the need for used cars in India, in the years to come.