What does PVIFA calculator’s mean and its Benefits

What does PVIFA mean and its Benefits?

Fundamental arithmetic activities can be achieved effectively by many individuals. Imagine a scenario in which you are approached to make choices with respect to interest in any business. You will feel it hard in light of the fact that you have close to zero familiarity with the fundamental workings of financial aspects or business science.

Allow us to show you perhaps the most helpful term or strategies to get help with this interaction. PVIFA can help you in checking whether you ought to take your venture back as a solitary installment or get it in annuities. If you have any desire to ascertain your general fat mass then you can utilize rfm calculator.

What’s the significance here?

PVIFA represents the Present Worth Interest Element of Annuity. It demonstrates the worth of your venture when you are getting it in annuities. Don’t you understand what annuity implies? It implies achievements in basic language that you will make to get your cash back from somebody.

This estimation depends on the Time worth of cash which demonstrates that the worth of the cash you are getting today is considerably more than the worth after certain years. You can comprehend this idea essentially by checking the accompanying model out.

In the event that you have a couple of dollars in your pocket and put them into a business, will you get a similar sum following a year? No, you will get some extra benefit alongside the gross venture that you have in your pocket. Yet, you will get a similar sum following a year in the event that you simply keep it in your wallet.

This shows that the value of cash you have today is substantially more than the worth of a similar sum following a couple of months or years. PVIFA depends on this idea that empowers the individual to find out about certain elements like return, benefit, and others.

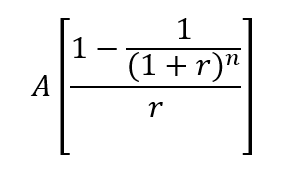

Here is the recipe for PVIFA estimation.

• PVIFA = (1 – (1 + r)^-n)/r

PVIFA calculator can be an efficient and precisely working instrument for you in the event that you don’t have the foggiest idea how to ascertain this. It just requests fundamental information or knowledge of any internet based instrument from the client to utilize it.

Benefits of using PVIFA

The greatest benefit of utilizing PVIFA is that it empowers you to settle on your installment. It shows whether you ought to take a proper sum back now or acknowledge an annuity installment framework over years.

As referenced over, the PVIFA recipe has a loan cost that can assist you with checking what you will get toward the finish of the annuity installment period. By utilizing the financing cost, you can get a last sum that you will move past a timeframe in annuities. To get more data then you can visit here calculatorsbag.

Presently, you can contrast this sum and the decent one that you are proposed to take right now. In this way, you can have a thought of what will be more valuable for yourself and which technique you ought to acknowledge for your installments.

In any case, remember that you ought to have the loan cost and the annuity period to compute PVIFA from a manual as well as a PVIFA number cruncher. It can’t be determined without these terms or values. I have

What is PVIFA utilized for?

PVIFA is for the most part used to work out the contrast between a decent sum and getting installment in an annuity framework. It can likewise let you know the pace of return on a specific sum by utilizing rebate rate estimation with a similar computation process.

It can likewise help you in the event that you are a money manager and hoping to finalize a negotiation with financial backers. You can change the pace of return utilizing the PVIFA mini-computer by having a thought regarding the progress of your business or the dangers that might come your direction during the annuity time frame.

By doing this, you and your financial backers can have a reasonable thought of regardless of whether they ought to go with the arrangement. Everything relies upon the states of whether you ought to go with an exorbitant loan fee or a low-financing cost.