Payroll is the process of calculating, managing, and distributing employee compensation, including salaries, wages, bonuses, and deductions within a company. It is a crucial function for businesses of all sizes, as it ensures that employees are paid accurately and on time. Here are some key reasons why payroll software in UAE is important in a company:

Importance of Payroll Software in UAE

- Employee Satisfaction: Accurate and timely payroll processing is essential for employee satisfaction. When employees are paid correctly and promptly, it boosts morale and helps retain talented individuals within the organization.

- Legal Compliance: Payroll must adhere to various federal, state, and local labor laws and tax regulations. Failing to comply with these laws can result in penalties, fines, and legal issues for the company. Proper management ensures legal compliance.

- Tax Reporting: Companies are responsible for withholding income taxes, Social Security, and Medicare taxes from employee paychecks and remitting them to the appropriate government agencies. Accurate ensures that these taxes are collected and paid correctly.

- Record-Keeping: Payroll records are crucial for auditing, tax filings, and historical tracking of employee compensation. Keeping accurate records helps businesses maintain financial transparency and assists in case of disputes or audits.

- Budgeting and Financial Planning: Payroll data is essential for budgeting and financial forecasting. It allows companies to estimate labor costs accurately, allocate resources efficiently, and plan for growth or cost-cutting measures.

More Importance

- Employee Benefits Management: Many companies offer benefits like health insurance, retirement plans, and paid time off. Proper management ensures that these benefits are administered correctly and that employees receive the benefits they are entitled to.

- Garnishments and Deductions: Payroll handles various deductions, such as wage garnishments for child support or creditor payments.

- Reporting and Analytics: Payroll data can be used to generate reports and analytics that provide insights into labor costs, overtime trends, employee turnover, and other critical workforce metrics. This information is valuable for decision-making.

- Trust and Reputation: Accurate and reliable payroll processing builds trust with employees, which can enhance the company’s reputation as an employer of choice. On the other hand, errors can damage the company’s reputation and employee trust.

- Cost Control: Efficient payroll management helps control costs associated with payroll processing. Automation and accuracy reduce the risk of overpayments and reduce the administrative burden on HR and finance departments.

In summary, is vital for a company because it ensures that employees are compensated fairly and in compliance with legal requirements. It also plays a significant role in financial management, compliance, and maintaining a positive employer-employee relationship. Proper payroll management is essential for the overall success and stability of a company.

What is payroll system in HR

A payroll system in HR software refers to the process and software used by organizations to manage and process employee compensation, including salaries, wages, bonuses, and deductions.. Here are some key aspects of a system in HR:

Key aspects of a payroll system in HR

- Employee Information Management: The system stores and manages essential employee information, including personal details, tax information, banking details, and employment history.

- Time and Attendance Tracking: It records employee work hours, attendance, leaves, and overtime to calculate accurate compensation. Some systems integrate with timekeeping devices like biometric scanners or digital time clocks.

- Salary Calculation: The system calculates employee salaries and wages based on various factors, including hourly rates, monthly salaries, overtime rates, and any applicable bonuses or commissions.

- Deductions and Taxes: It automatically deducts applicable taxes, social security contributions, retirement contributions, and other deductions, ensuring compliance with tax laws and regulations.

- Payment Processing: Once the payroll is processed, the system facilitates the distribution of payments to employees through various methods, such as direct deposit, paper checks, or electronic payment platforms.

About More

- Record Keeping: The payroll system maintains a historical record of all payroll transactions, including past payslips, tax filings, and other related documents. This record-keeping is crucial for auditing, compliance, and historical reference.

- Reporting: HR and finance professionals can generate various reports from the payroll system, such as payroll registers, tax reports, and employee earnings summaries. These reports help in decision-making, financial planning, and compliance.

- Compliance and Legal Requirements: The payroll system must comply with federal, state, and local labor laws and tax regulations, ensuring that taxes are withheld correctly, and reports are submitted on time.

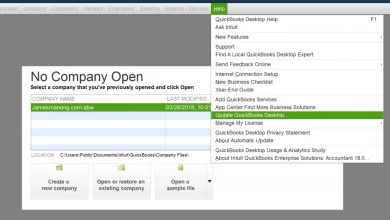

- Integration: Many organizations integrate their payroll system with other HR and finance software, such as HRIS (Human Resources Information System) and accounting software, to streamline processes and data sharing.

- Security: Payroll data contains sensitive information, so payroll systems must have robust security measures in place to protect against data breaches and unauthorized access.

Overall, an effective payroll system in HR helps organizations manage one of their most significant expenses (employee compensation) efficiently, accurately, and in compliance with relevant laws and regulations. This not only ensures employee satisfaction but also minimizes the risk of legal and financial penalties associated with payroll errors.

What is payroll system functions?

These functions are crucial for any organization to maintain employee satisfaction, comply with labor laws, and manage financial records. Here are the primary functions of a payroll system:

-

Employee Information Management:

- Collect and store employee data, including personal information, tax withholding details, bank account information for direct deposit, and employment history.

-

Salary and Wage Calculation:

- Calculate gross wages or salaries based on hourly rates, salaries, or commission structures.

- Apply any relevant deductions, such as taxes, benefits, and contributions.

-

Tax Calculation and Withholding:

- Calculate and withhold federal, state, and local income taxes based on employee earnings and tax withholding allowances.

- Calculate and deduct other taxes like Social Security and Medicare contributions (FICA).

-

Benefits and Deductions:

- Manage and apply employee benefits, such as health insurance premiums, retirement contributions, and other voluntary deductions.

- Deduct employee contributions to retirement plans like 401(k) or pension funds.

-

Time and Attendance Tracking:

- Monitor and record employee work hours, including regular hours, overtime, and any paid time off (e.g., vacation and sick leave).

- Calculate overtime pay and ensure compliance with labor laws.

-

Payroll Processing:

- Generate paychecks or initiate direct deposits to employees’ bank accounts.

- Issue pay stubs detailing earnings, deductions, and net pay.

- Ensure timely payment to employees, following the organization’s pay schedule.

-

Compliance and Reporting:

- Stay compliant with tax laws and regulations, including filing payroll taxes accurately and on time.

- Generate and submit required reports to government agencies (e.g., W-2 forms for employees, 941 forms for federal taxes).

- Provide employees with annual statements of earnings and deductions (e.g., W-2 forms).

-

Recordkeeping:

- Maintain detailed records of transactions, including historical data for auditing and reporting purposes.

- Archive payroll records in accordance with legal requirements.

-

Data Security:

- Ensure the security and confidentiality of sensitive employee payroll information.

- Implement access controls to protect payroll data from unauthorized access.

-

Integration with Accounting:

- Seamlessly integrate data with the organization’s accounting software to maintain accurate financial records.

-

Employee Self-Service:

- Offer employees self-service portals where they can access pay stubs, update personal information, and view tax documents.

-

Year-End Processes:

- Handle year-end tasks such as reconciling data, preparing for tax reporting, and generating annual tax forms.

-

Customer Support:

- Provide support for employees who have questions or issues related to their paychecks, deductions, or tax withholding.

A well-managed payroll system streamlines the compensation process, reduces errors, ensures compliance with legal requirements, and enhances overall employee satisfaction by delivering accurate and timely compensation.