In this article, we will probe for taxation via QuickBooks. QuickBooks allows printing important documents like W-2 to print. Employers have to deliver a W-2 form containing all the details like wages, annual salary, tax deductions (both state and federal), and payable amount in hand to the worker. Workers who get paid below $600 needn’t W-2 form. Most of the time either for correction or loss, employers have to reprint W-2 in QuickBooks.

Discussion continues here.

QuickBooks’s Role in Taxation

QuickBooks happens to be the go-to accounting software for the small to mid-level merchants’ crowd. This application solves the needs of bookkeeping, bank reconciliation, payroll, taxation, etc. and when it comes to printing W-2, it does that too. This particular facility is available in all versions of QuickBooks.

Read more: boast city

What is W-2 in QuickBooks?

Employers deliver Form W-2 to report employee wage and salary information to the IRS. Plus, other than the aforementioned taxes as well as other employer fringe benefits like health insurance, assistance with adoption and dependent care, contributions to health savings accounts, and other benefits, needs to be detailed on the W-2. When preparing the tax return as an employee, the information on the W-2 is very important. Hence, reprint W-2 in QuickBooks.

What is the difference between a 1099 and a W-2?

The purpose of Forms W-2 and 1099 is to report income earned throughout the tax year. The circumstances under which you receive them and the taxes withheld from them are the only things that set them apart. A W-2 should be sent to you by your employer whenever you work as an employee. Instead of a W-2, the company will likely send you a Form 1099-NEC if you work as an independent contractor. The tax withholdings are primarily what differentiates a W-2 from a 1099. Throughout the tax year, employers (W-2) send money on your behalf to various tax agencies by withholding money from your pay. As a self-employed individual (1099), the company that pays you rarely withholds money on your behalf. Each year, you are responsible for making your own payments toward your owed taxes.

- How do I find my W2 in QuickBooks?

- How do I record W2 income in QuickBooks?

- how to reprint old w2 in QuickBooks

- How do I prepare a W-2 for an employee in QuickBooks?

- How do I send W-2s to employees in QuickBooks?

How do you distribute W-2s to employees?

QuickBooks allows you to distribute W-2 forms to employees in the following way:

- Visit the Employees menu and select Payroll Tax Forms & W-2s.

- Select W-2s from the submenu.

- Choose the year for which you want to create the forms.

- Select the employees for whom you want to create forms.

- Click Create Forms and QuickBooks will generate the W-2 forms for the selected employees.

- Select the forms you want to print, email, or save as PDFs.

- You can print or email the forms to your employees, or save them as a PDF and distribute them electronically.

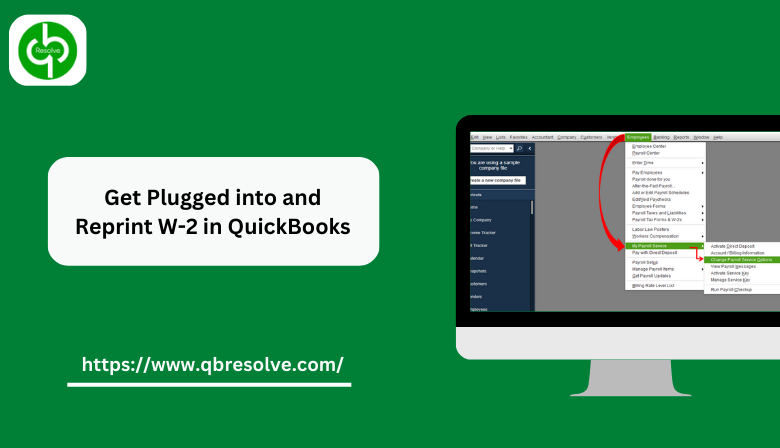

Check Your Payroll Service Before Beginning W-2 Printing

Before printing the W-2 form in QuickBooks, you must be aware of the version of QuickBooks Payroll you are currently using because the process may differ depending on the version. However, if you are unsure of it and confused, the following steps must be taken:

- First, sign in to QuickBooks Online.

- Under Settings, you’ll find Accounts and Settings, Payroll, and Billing Subscription.

- Click on Plan details to learn more about your current payroll plan.

- Self-service QuickBooks payroll is available if either Enhanced or Basic is displayed.

- On the other hand, selecting Full-service payroll indicates that you are utilizing the QuickBooks Full-Service Payroll version.

Tell me how do I reprint the W2 form from 2021 from my employee

You can reprint your employee’s W-2 form from 2021 by logging into your employer’s payroll website or employer portal. You may need to enter your employee’s employee ID or Social Security number to access their W-2 form. Once you have accessed the employee’s information, you should be able to print a copy of their W-2 form.

View and print your W-2s in QuickBooks Workforce

QuickBooks Workforce allows you to view, print, and save your W-2s directly from the app. To do so, first, log in to your QuickBooks Workforce account. Once you are logged in, click on the “My Payroll” tab. From here, you can access your W-2s by clicking on the “Tax Documents” tab. Here, you will see a list of available W-2s. To view, print, or save a W-2, simply click the “View/Print” button next to the document you wish to access. You can also click the “Download” button to save the document to your computer.

Can I find the w2 archive to reprint a w2?

Yes, you can find the W-2 archive to reprint a W-2. Many employers are now offering the ability to access and reprint employee W-2s online through their employee portal. You can also contact your employer’s payroll or HR department for assistance.