Talking about SUI, stands for State Unemployment Insurance. It renders short-term benefits to our employees that lost their data due to a variety of reasons. If you are interested in finding out how to change the SUI rate for basic, Enhanced or Standard Payroll make sure to read this post till the end. Note that the SUI rates are important for your large business and are issued by a state. SUI tax rate is not a part of payable tax & it is critical that a user entered their tax rate in their QB desktop software. This tax is paid by the employer until and unless you state, that employees need to contribute to each other. Read ahead to learn more about the same. Or you can also speak to our experts at +1-844-405-0907 and they will provide you with further information.

Steps to Change the SUI tax rates in Enhanced or Standard Payroll

The user can try to perform the below steps to change the SUI tax. The steps involved are as follows:

- First, select the option of Lists. Then click on the Payroll item list.

- Now, double-click on the SUI tax item, which is typically named: [state abbreviation] – unemployment company.

- After that head to the next key button.

- Click just next to the company tax rates as yearly.

- An account is required to type the correct rates as quarterly.

- Also remember that, if your device date is 7/1 & 1/1 that a user will now be able to include the rate for the first quarter as for annually.

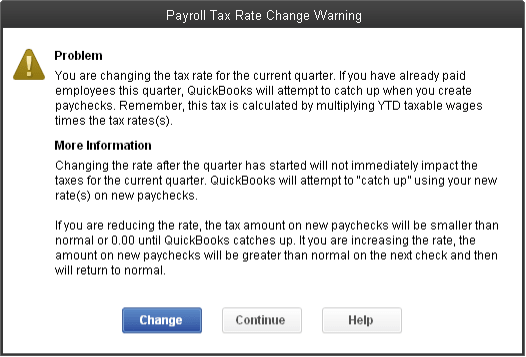

- In case you mention all correct rates, or you get an error message as Payroll Tax Rate change Warning on your desktop screen, then click on the continue option.

- This will now be updated

- After that click on the next option

- Click to clear all unnecessary items which are having no matter related with SUI tax.

- Hit the next option and then click on the finish button,

- In case you want to change or require to do some modifications in Sui wage bases or sums that are reported to our workers. Set up a payroll report and standardized these numbers.

Important Facts About SUI Tax Rates

- SUI tax rates are important to your business and issued by your state.

- SUI rate is not a part of the tax table update and critical that you type your current rate in QuickBooks Desktop.

- It paid only by the employer unless you are in a state that requires workers to contribute.

- The SUI wage base limit is updated by the tax table according to your state’s requirements and cannot be manually modified.

- Most states update their SUI rates at the beginning of the year, while others like New Jersey, Vermont, and Tennessee, update their rates in the third quarter of the year.

The majority of states attaches a surcharge or assessment to state unemployment. To ensure that you type the correct percentage rate for the SUI portion:

- Compare the breakdown of the rate on your notice with a sample copy for your state.

- If your state attaches an assessment or surcharge item, update the rate for that payroll item in QuickBooks.

By the end of this post, we expect that the reader might be able to change the SUI rates. However, if for some reason you aren’t able to or if you are stuck at any point in time, then contacting our QuickBooks Payroll Support team at +1-844-405-0907 is suggested. We are a team of certified QuickBooks professionals who work round the clock in providing immediate support services.